York Region Economic Data & Reports

Please use the accordions below to find economic data, economic development reports and publications, business incentive programs, and more resources related to economic development in York Region.

Economy by the Numbers

Businesses

New Businesses

Annual average

2014 - 2023

Local Jobs

Local Labour Force

Estimated 2024

Nominal GDP

2024

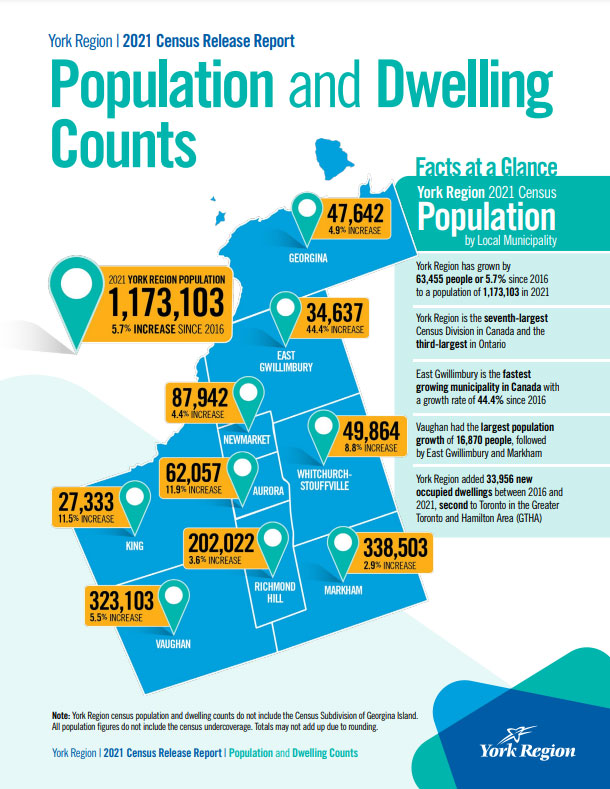

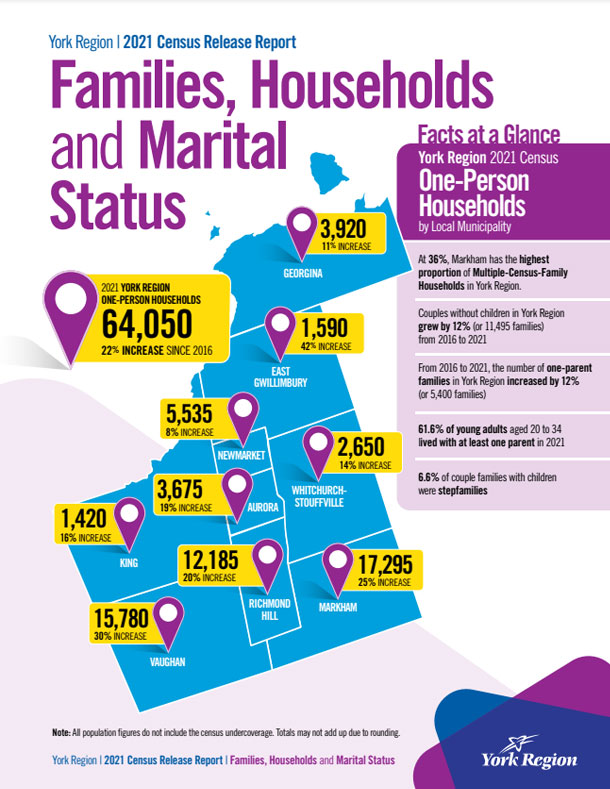

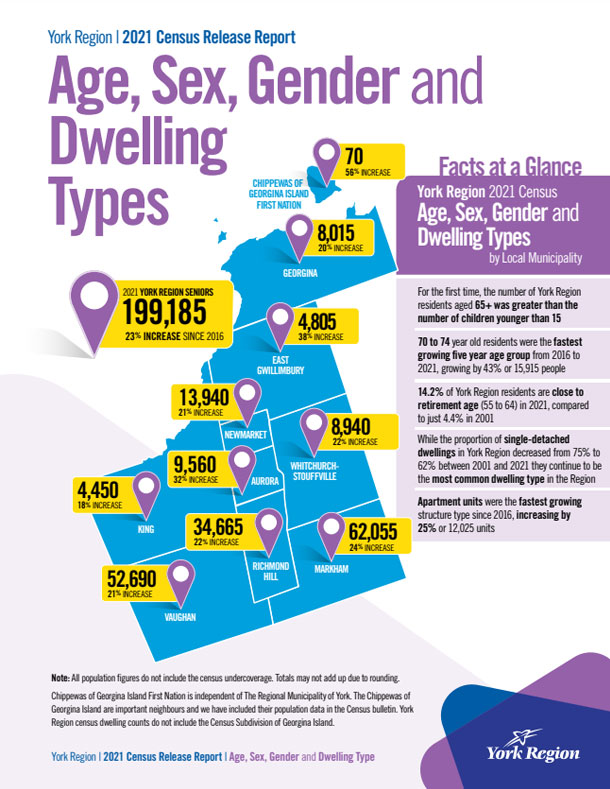

Residents

2025

Population Growth

Annual average

2014 - 2023

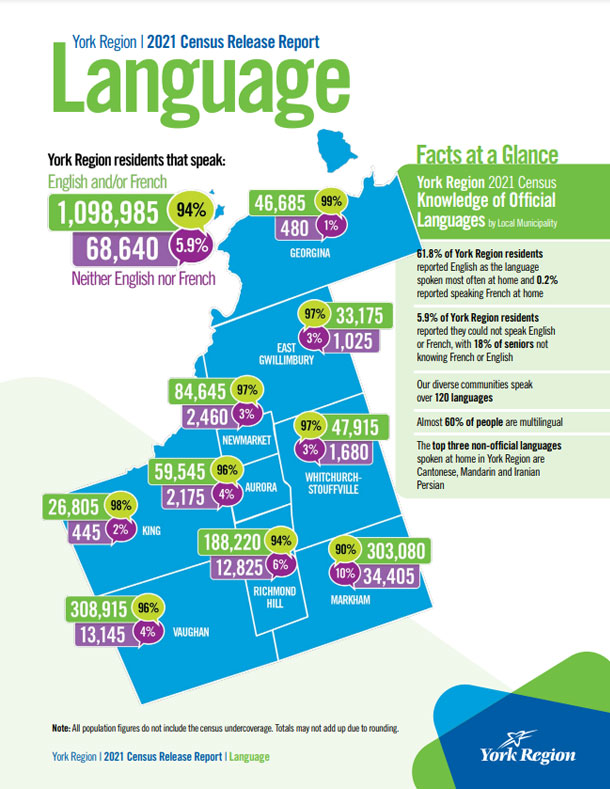

Distinct Ethnicities

2021 Census

Languages Spoken

2021 Census

Universities & Colleges

Within commuting distance

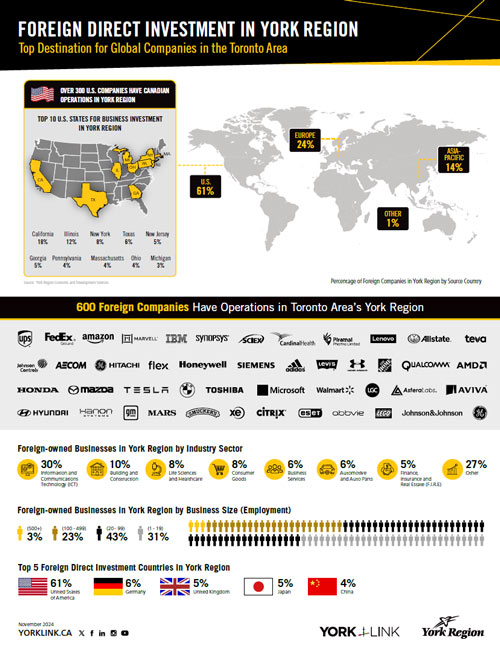

Fortune 100 Companies

With operations in York Region

Corporate R&D Spenders

Have major operations in York Region

STEM & Business Graduates

Reside in York Region

in Growth Infrastructure Investments

2024 Estimates

Total Construction Value

2023

Business Ecosystem Tools

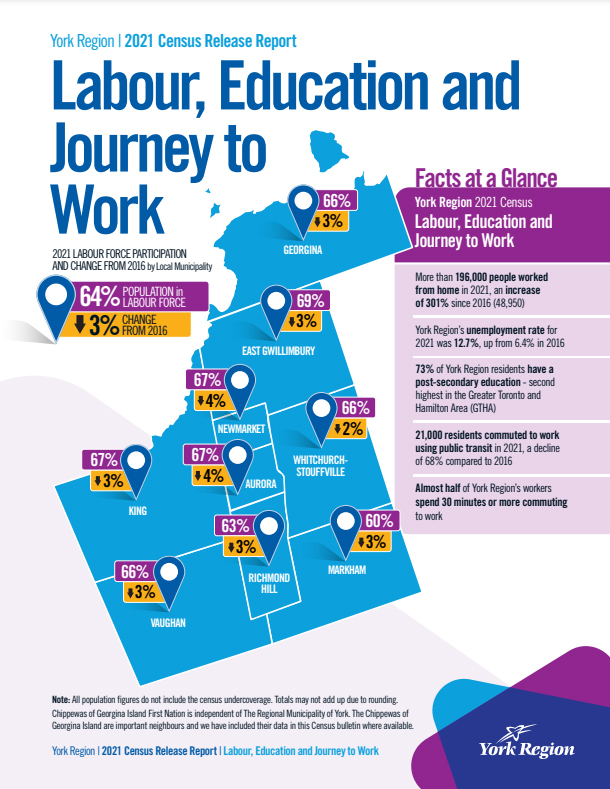

Labour Force & Demographic Data

York Region Population Dashboard

Reports

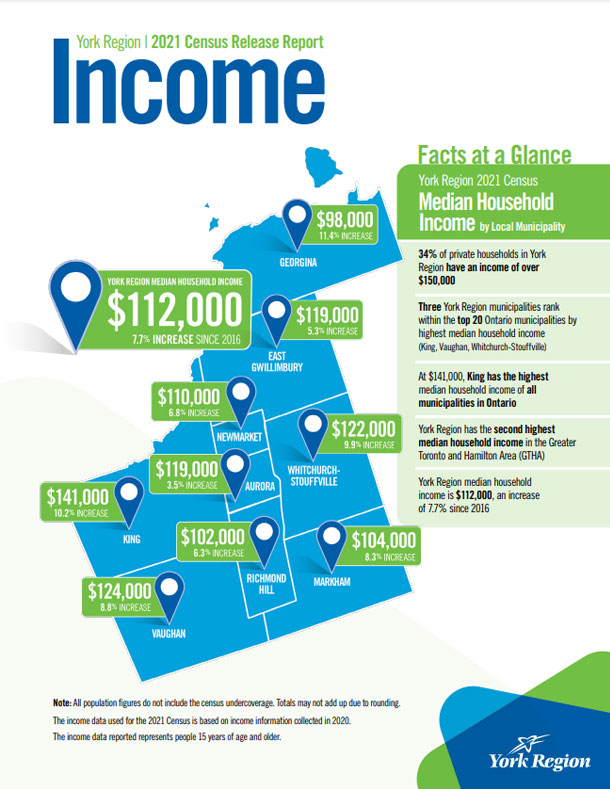

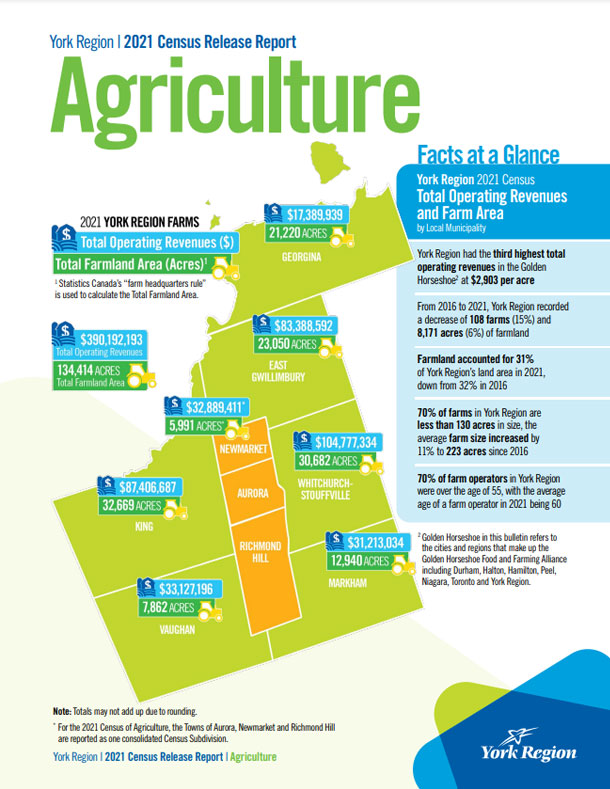

Census Data

Unemployment Rates

No Data Found

Source: Statistics Canada | Labour Force Characteristics, 3-month moving average, unadjusted for seasonality, NOC 2021, custom tabulation

*CMA – Census Metropolitan Area

Manufacturing Talent Toolkit

Industrial & Office Real Estate Data

Industrial Real Estate Vacancy & Availability Rates

No Data Found

Source: CoStar | Note: Industrial properties include flex building space

Office Real Estate Vacancy & Availability Rates

No Data Found

Source: CoStar

Economic Development Reports & Publications

Business Incentives

Business incentives come in a variety of forms including, but not limited to, funding (loans & grants), landing support, and development charge deferrals and are offered through multiple levels of government. In this section you will find resources to available business incentives at a regional, provincial, and federal level. Additionally, York Region’s local municipalities may have additional business incentives available.

Regional Programs

LARGE OFFICE INCENTIVES

On October 24, 2024, York Regional Council approved a new large office incentive program to enhance York Region’s economic prosperity and job growth.

The large office incentive program, which targets office buildings 75,000 square feet or more and built in Regional growth centres, Major Transit Station Areas or Specific Local Centres includes a Development Charge Deferral of up to 20 years and a potential development charges discount.

Under the development charges deferral program, the full development charges payable could be deferred, interest free, for between 5 and 20 years and would not require a letter of credit. To qualify, buildings must also be a minimum of 4 storeys and local municipal participation is required. For further details, see the table below.

The ultimate decision on whether to implement the discount will be made as part of the update of the Region’s Development Charges Bylaw, which is expected to be brought forward to Council in February 2026.

| Gross Floor Area Size Threshold | Duration of Development Charges deferral available on Regional Centres and Corridors, Major Transit Station Areas, or on specific Local Centres |

| Between 75,000 square feet and less than 150,000 square feet | 5 years |

| Between 150,000 square feet and less than 250,000 square feet | 10 years |

| 250,000 square feet and greater | 20 years |

For more information, please visit york.ca/developmentcharges or contact the Region at 1-877-464-9675, extension 71696 or 71660.

INDUSTRIAL DEVELOPMENT CHARGE INCENTIVES

Reduction of Development Charges Where Gross Floor Area is Increased

3.16 Notwithstanding any other provisions of this bylaw, if a development includes the expansion of the gross floor area of an industrial, office or institutional building, the amount of the development charge that is payable in respect of the expansion shall be calculated as follows:

(a) If the gross floor area is expanded by fifty percent of the original gross floor area of the existing development, or less, the amount of the development charge in respect of the expansion is zero.

Source: The Regional Municipality of York Development Charges Bylaw 2022

Provincial Programs

Federal Programs

DISCLAIMER:

These resources are aggregated from a variety of sources. Links to third-party resources listed on this website are provided as an information service to the local business community. York Region Economic Strategy does not endorse, recommend, or approve the suitability of any third-party resources unless stated otherwise, and users should make their own inquiries and conduct due diligence as necessary. The Regional Municipality of York shall not be liable or responsible for any matter arising from use of these resources.

Subscribe to

Our Newsletter!

The York Region Business Update monthly newsletter recaps top business news stories, funding programs, local business events and other information related to the York Region Business community.